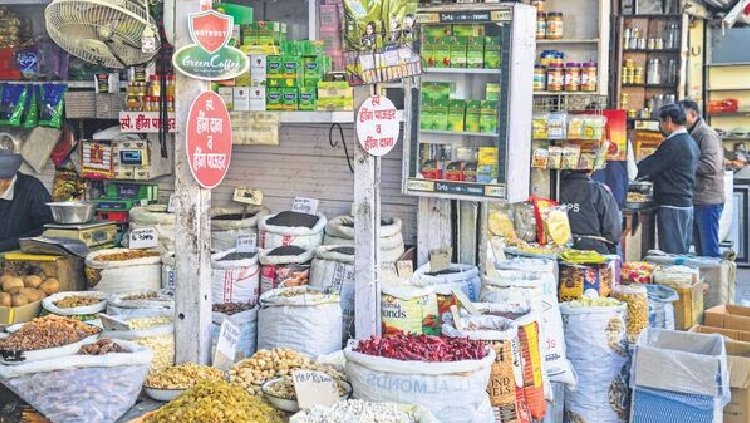

Pre-Diwali Shopping Drives 4.4% Surge in Festive FMCG Sales

During the festive season, dairy, home care, confectionery, and gifting boxes emerged as pivotal contributors, significantly boosting FMCG sales

Fast-moving consumer goods (FMCG) sales, excluding staples like cooking oils and grains, experienced a 4.4% upturn during this year's Diwali season, states Bizom, a retail intelligence platform. The analysis spanned 14 days leading up to Diwali in 2022 and 2023. The surge was led by categories such as dairy, home care, confectionery, and gifting boxes, while beverages faced a decline of 4.7% in demand. The rise was notably fueled by a 38% increase in dairy product sales and a 16.5% surge in confectionery.

Pre-Diwali stocking at retail outlets observed a mid-single-digit growth, particularly noticeable among local kirana stores across various product categories. However, five days before Diwali, packaged goods experienced a moderate 2% year-on-year increase in demand.

Bizom's Chief of Growth and Insights, Akshay D’Souza, attributed the upsurge in dairy sales to the preparation of festive sweets and savories in households. He emphasized a strong demand for ghee, butter, curd, and other dairy items, noting a surge in confectionery sales due to increased gifting trends during Diwali celebrations.

This sales growth is considered significant in the context of recent consumption patterns that have pressured FMCG growth. The comparison with the last Diwali period, which experienced a surge in packaged goods demand, emphasizes the significance of this year's sales growth.

Bizom excluded edible oils and staples from the data due to continuous price drops, impacting overall sales. D’Souza highlighted the diminishing sales growth for branded commodities due to the price decline in edible oils.

Additionally, demand for home care products surged by nearly 12%, driven by the need for cleaning and hygiene products during Diwali gatherings. Packaged foods observed a modest 1% rise in sales, while personal care goods experienced a decline of nearly 9% year-on-year.

As November progresses, the mismatch between store-level stocking and actual consumption might lead to increased inventory days. This could prompt brands to offer discounts to clear stock and expedite restocking.

Despite FMCG sales registering a nearly 5% upswing in September year-on-year, the September quarter saw a 2.3% decline, primarily due to decreased demand for branded commodities and beverages.

Sumit Rawat

Sumit Rawat