Auto sector excels in digital AdEx, led by paid search

Auto industry heads highlight sector's growing digital ad spend. Emphasis on search ads, followed by online video and social media, reflects a diverse advertising approach for sustained growth

In the recently unveiled dentsu e4m digital advertising report 2024, the automotive sector's advertising spend emerges as a formidable force, reaching Rs 5,223 crore, constituting 6% of the total ad expenditure across industries.

Digital media asserts dominance, capturing a significant 35% share of the auto sector's total ad spending, surpassing print (33%) and television (27%). In terms of value, the digital media spend amounts to Rs 1,815 crore, contributing about 5% to the digital ad landscape.

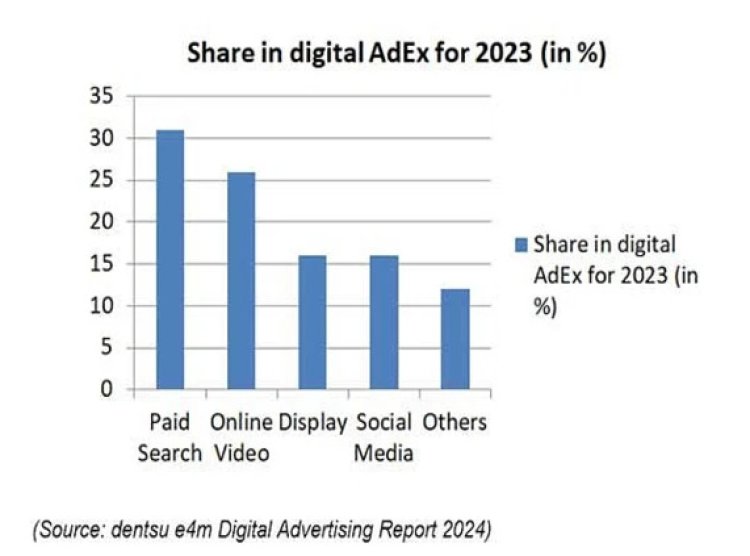

Within the digital realm, paid search emerges as the favored avenue for auto brands, with approximately 31% of their digital ad budget allocated to this format. This is followed by online video (26%), display, and social media at 16% each, with other digital media formats constituting around 12%.

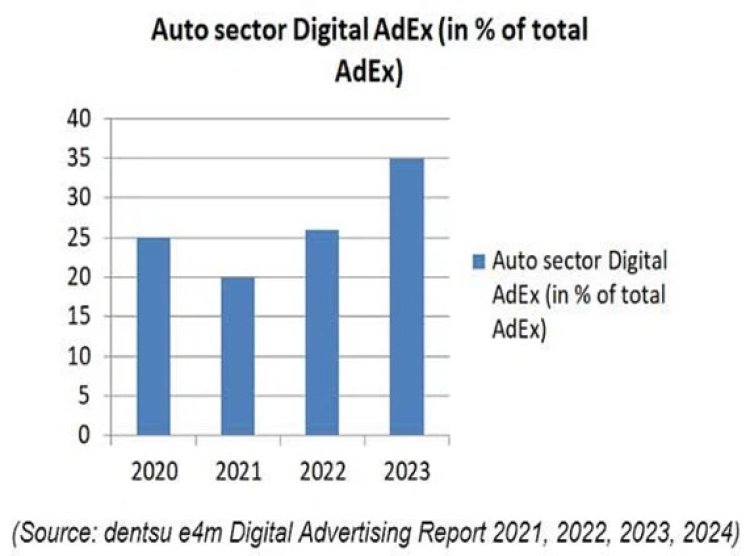

Reflecting on the sector's trajectory over the years, the 2023 share of Rs 5,223 crore marks a subtle 2% increase from the previous year. Notably, the shift towards digital is evident, with the sector's digital ad budget growing from 26% in 2022 to a robust 35% in 2023.

In 2021, the digital inclination was modest at 20%, witnessing a dip from 2020's allocation of 25%. The total digital ad pie for the auto sector in 2021 stood at a modest Rs 970 crore.

Insights from industry leaders shed light on the driving forces behind this digital evolution. Hero MotoCorp's Emerging Mobility Business directs a significant 60-70% of its ad budget to digital, witnessing a remarkable 40% surge in digital ad spend in 2023 compared to 2022.

Maruti's Shashank Srivastava shares insights into their digital transformation, with spending escalating from 29% to 36% of the total budget, showing a 20% growth. Srivastava emphasizes the changing consumer landscape due to increased digitalization, with digital spend nearly equaling television spending across the auto industry at 26% of the overall media budget.

Despite these shifts, exceptions exist. Virat Khullar, Group Head - Marketing at Hyundai Motor India Limited, reveals a TV-centric approach, with television claiming 55% of the ad budget, digital at 35%, and the remaining 10% dedicated to experiential marketing.

Industry experts foresee continued growth in the automotive segment, driven by increased consumer income, rising demand, and the growing need for personal mobility. Government initiatives, such as the Production Linked Incentive (PLI) schemes, coupled with environmental awareness, are fueling demand for fuel-efficient electric and hybrid vehicles.

India's investments in infrastructure and urbanization play a pivotal role in the automotive sector's trajectory, contributing significantly to the country's overall economic development.

Sumit Rawat

Sumit Rawat