Zee-Sony and RIL-Disney: corporate mergers shaping entertainment landscapes

Exploring the mergers' market status by evaluating their values and share distribution for a comprehensive insight into their positions

The Indian broadcasting sector finds itself in a tumultuous phase as the Zee-Sony merger confronts delays. Zee's plea for an extension clashes with Sony's assertion, indicating a potential failure to meet the merger deadline.

Amidst this uncertainty, speculations swirl around another potential merger involving Disney Star and Viacom18. Reports suggest Disney is nearing a pact with RIL, anticipating RIL to secure a controlling stake in Disney Star, while the American entertainment giant retains a minority share.

Market speculation intensifies as industry watchers await the outcome of these merger talks. Here's an overview of their current estimated market standings:

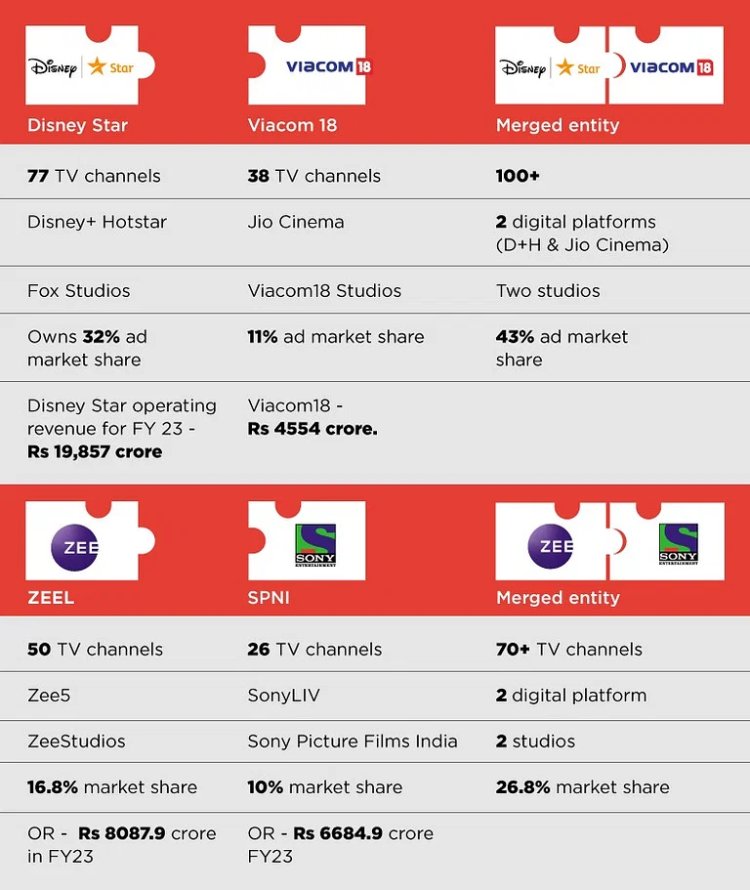

Disney Star-Viacom18 Merger:

Disney Star holds sway with 70+ TV channels across eight languages, Disney+ Hotstar streaming, and a film studio. Viacom18, under Reliance, boasts 38 TV channels, Jio Cinema streaming, and Viacom18 Studios.

The merger promises dominance in the ad market, with Elara Capital indicating a potential 43% share. The unified entity would encompass 100+ TV channels, two streaming platforms, and two film studios.

Financial Overview:

Disney Star's FY23 revenue tallied Rs 19,857 crore, dwarfing Viacom18's Rs 4,554 crore.

Zee-Sony Merger:

Formerly SPNI, now Culver Max Entertainment Private Limited, registered FY23 revenue of Rs 6684.9 crore, managing 26 TV channels, SonyLIV streaming, and Studio NEXT for original content and films.

In contrast, ZEEL recorded FY23 revenue at Rs 8087.90 crore, operating 50 channels in 11 languages, Zee5 streaming, Zee Studios, a film production unit, and Zee Music.

If the merger materializes, the conglomerate would oversee 70+ TV channels, ZEE5 and Sony LIV streaming, and film studios, commanding a 26% market share.

Sumit Rawat

Sumit Rawat