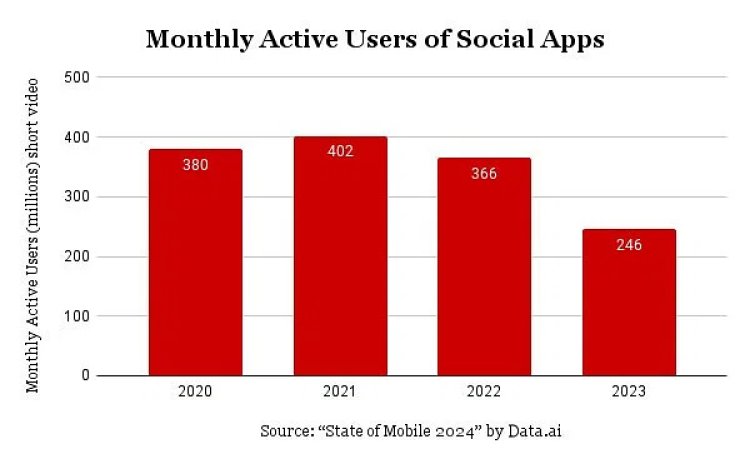

Videos lose appeal: 33% dip in monthly active users, 2023

Short video platform's monthly users sharply decline from 366 million in 2022 to 246 million in 2023, as per industry report findings

Short video applications, once the darlings of India's digital landscape, are experiencing a downturn. According to Data.ai's latest report, the average monthly active users (MAU) in this category plummeted by 40 percent in 2023 compared to its peak in 2021.

In 2023, the average MAU for short videos stood at over 245 million, a significant drop from 366 million the previous year and 402 million in 2021, as revealed in the "State of Mobile 2024" report.

While specific app data remains unavailable, industry insiders speculate that indigenous platforms may have suffered more compared to global behemoths such as Instagram (Meta) and YouTube Shorts (Google). Several Indian apps have shuttered, witnessing steep valuation declines over the past two years.

Conversely, short video platforms continue to captivate global audiences, with average MAUs climbing from 2.9 billion to 3.4 billion over the past two years.

The popularity of short videos surged in India following the ban on TikTok, the Chinese app, in mid-2020, leading to the emergence of both global and indigenous players.

Additionally, the report highlights muted growth for social media networks in India between 2022 and 2023, notably microblogging platforms like X.

Despite the post-pandemic return to normalcy, video content remains the highest-earning segment, witnessing an 11 percent increase in revenue share since 2019. Indians spent nearly 25 billion hours streaming entertainment content in 2022, a 52 percent increase from 2019, according to an EY report.

As social media platforms, particularly short videos, attracted more attention, brands increased ad spends in this space. FMCG giants allocated over 30-50 percent of their digital ad budgets to short videos and 25 percent to social media apps.

However, industry experts expressed surprise at the report's findings, considering the prevailing belief in recent years that short-form content would dominate social media, catering to dwindling attention spans.

Short videos, known for their snackable format and addictive content, evolved into a cultural phenomenon. Nevertheless, they now seem to have reached a saturation point, akin to other social media platforms, marking a stabilization in India's mature mobile market.

Sachin Kumar, founder of Bottle Openers, attributed the decline in short video engagement to waning interest among consumers, who increasingly seek comprehensive information.

Contrary to this, a senior ad executive disputed the report's findings, suggesting that the decline may be specific to Facebook's primary user base in India, rather than indicative of the broader short-form video landscape.

Despite the decline, Syed Ahmed Aftab Naqvi, Global CEO and Co-founder of Gozoop group, remains optimistic about short-format content's enduring appeal, particularly among India's youth, who continue to drive online consumption trends.

Sumit Rawat

Sumit Rawat