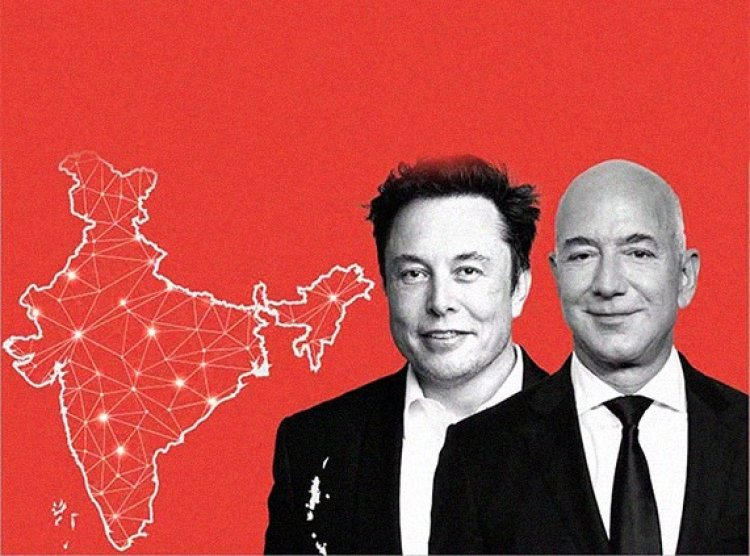

Why are Elon Musk & Jeff Bezos eyeing India's SatCom market?

Elon Musk and Jeff Bezos apply for licenses to offer satellite internet in India. The new Telecommunications Act allows administrative spectrum allocation for these services

Elon Musk, CEO of Tesla and SpaceX, during a meeting with Prime Minister Narendra Modi, expressed his intention to bring Starlink internet to India. He plans to visit in the upcoming year, capitalizing on the potential offered by India's burgeoning satellite internet market.

The recent enactment of the new Telecommunications Act on December 27 has significantly altered the landscape, allowing for administrative allocation of satellite internet spectrum. This departure from traditional auctions is seen as a triumph for Starlink and other satellite internet firms that advocated against the auction route.

Starlink, owned by Musk's SpaceX, has applied for licensing of global mobile personal communication by satellite services (GMPCS), currently under evaluation by the government. Similarly, "Project Kuiper" by Jeff Bezos-led Amazon is seeking regulatory approval for its satellite services in India.

Upon acquiring all necessary licenses and spectrum, both Musk and Bezos-led companies will be poised to offer messaging, voice, and broadband services to individuals and organizations in India.

Anil Prakash, Director General at SIA-India, notes that any Indian entity aiming to offer satellite communication services must obtain a GMPCS license and spectrum from the Department of Telecom, along with authorization from the Indian National Space Promotion and Authorisation Centre (IN-SPACe), the space regulator.

Currently, the government has issued GMPCS licenses to JioSpaceFiber and OneWeb. JioSpaceFiber, a venture of Jio and SES, and OneWeb, a joint venture of Bharti Airtel and Eutelsat, are in competition for the first-mover advantage in the evolving Indian satellite communications market.

With over 800 million active internet users in India, the satellite broadband service market is predicted to grow annually by 36%, reaching $1.9 billion by 2030, according to Deloitte. The presence of the SatCom network will not only enhance connectivity but also reduce India’s reliance on terrestrial internet during challenging situations.

Starlink, with over 2 million active customers in 60 countries, and Project Kuiper, still in development, represent innovations in the satellite internet sector. Starlink boasts download speeds between 25 and 220 Mbps, while Kuiper claims to be around 30% faster than terrestrial fiber optical cables.

While SatCom may be a small market for urban mobile consumers, private enterprises, MNCs, and government departments are expected to be early adopters. Anil Prakash emphasizes that there is significant scope for every player in India's diverse market.

Despite the promising outlook, potential roadblocks include the absence of a chief at the Telecom Regulatory Authority of India (TRAI) since October 2023. TRAI is expected to recommend a pricing mechanism and set a reserve price for satellite spectrum once a new chairperson assumes charge. The government is anticipated to make this appointment soon.

Sumit Rawat

Sumit Rawat